That may be high, but it is not too lofty from my perspective. Assuming we see the company fairly valued at an adjusted P/E of 35 and a P/FCF ratio of 35. The company will grow into a fair valuation. If we, therefore, view TeamViewer as a whole and take into account the excellent growth prospects, then the company is currently cheaply valued in my view. The debt to adjusted EBITDA ratio is currently only 1.7 and is expected to drop to 1.6 in 2021. The company is also on a solid financial footing. According to analysts, EPS should almost triple by 2024. Conversely, we have to take intact growth into account here. TeamViewer is currently trading at an adjusted P/E ratio of 53.1 and a P/FCF ratio of 37. Management expects the adjusted EBITDA to remain stable at 50 percent until 2023 and increase after 2024 due to economies of scale. After 2023, the company even expects that it can continue to increase billings by 25 percent per year. It still aims to reach revenues of more than €1 billion in 2023. On the contrary, TeamViewer is sticking to its long-term prospects. So I think the revenue development here is not a cause for concern. From next year, revenues and billings are expected to converge. This effect will disappear only at the end of 2021.

TEAM VIEWER STOCK FULL

This is how TeamViewer describes it in its quarterly announcement:Ī significant amount of Q1 billings have been booked towards the end of the quarter and will therefore be recognized as revenue later in the year contributing to TeamViewer's full year 2021 revenue in the following quarters. Billings, on the other hand, only include the (NET) value of services or products TeamViewer billed to a customer. That is also why TeamViewer's revenue figures in fiscal years 20 differ from the so-called billings.

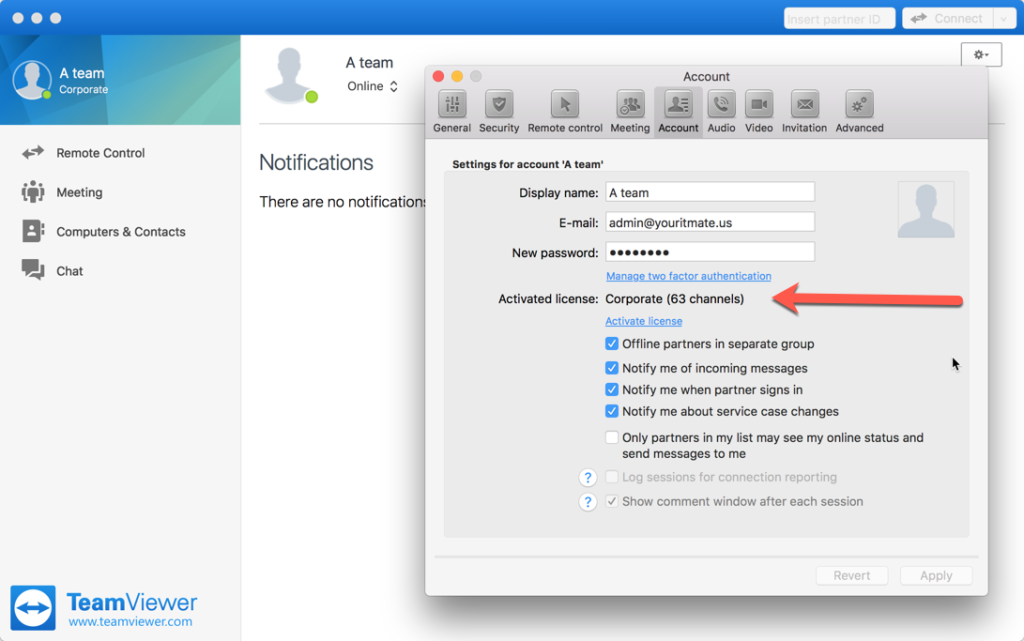

TEAM VIEWER STOCK LICENSE

This is important since the revenue figures still include revenue from the unlimited license models. However, this is due to a particularity, as TeamViewer has changed its business model from licenses to subscription. Nevertheless, revenues, for example, increased by only 15 percent compared to billings. Accordingly, the soccer club Manchester United, which is popular in the Asian region, can increase TeamViewer's brand awareness in Asia.īut why did the market react this way? Well, I think some investors acted emotionally. In this respect, the somewhat weaker growth in APAC underscores the importance of marketing efforts. For example, TeamViewer (billings) grew by 27 percent in EMEA, 28 percent in AMERICAS, and 17 percent in APAC. The consistent growth in the individual world regions is also vital. So far, it appears that after some easing of COVID-19 restrictions, companies have, on balance, kept the solutions purchased in the lockdown and are not quitting them. Apart from that, the net retention rate of 100 percent was again very satisfactory.

TEAM VIEWER STOCK SOFTWARE

It is difficult for large customers to switch software solution providers due to high switching costs. This development is excellent as it helps TeamViewer to build a moat. Overall, 15 percent of billings are already from customers with an order volume of over €200,000. More than 2,000 customers have a contract volume of over €10,000, which corresponds to a growth of 74 percent. The number of paying subscribers increased to 603,000, corresponding to a growth of 17 percent. In 1Q 2021, TeamViewer has benefited from new use cases, new products, and larger customers. My investment thesis, which I described in more detail in another article, is intact. TeamViewer is thus in a position to grow strongly even one year after the extreme demand for remote products due to the COVID-19 crisis. Growth in adjusted EBITDA of 22 percent was also strong, while the gross margin remained with 93 (!) percent well above 90 percent. Adjusted for foreign currency effects, billings increased by even 26 percent. Billings grew 22 percent compared to 1Q 2020. The 1Q results are not bad at all and within the expected range. Nevertheless, the associated uncertainty weighed on the share price, and it seems that the 1Q results were not enough to dispel this uncertainty. From my perspective, both deals and their consequences were already sufficiently priced into the share price. I already explained the background of the deals and gave my opinion ( see here). The EBITDA margin is expected to decline from 56 percent to 49-51 percent in 2021 due to these deals.

TeamViewer has announced that it will sponsor the Manchester United soccer club and the Mercedes Formula 1 team. Furthermore, two rather expensive marketing deals have caused doubts among investors. Firstly, the share already consolidated due to the fear of inflation and rising interest rates. TeamViewer stock has been a bit shaky lately.

0 kommentar(er)

0 kommentar(er)